Why Consumers Shifting to Digital Channels Means Your Travel Brand Should Embrace Conversational CX

Whether it was people going on holiday, travelling for business or just commuting to the office, the number of journeys being made across the global transport industry has dramatically dropped since March 2020. It’s going to be months, probably years, before it returns to pre-pandemic levels. If it ever does.

At Conversocial, A Verint Company, the majority of our partners in the transport sector fall within two categories – airlines and train operators. The data we have seen from the two tell different stories about the volume of conversations they’ve experienced since Covid hit.

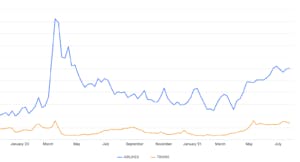

Daily Conversations for airlines and train operators on Conversocial’s platform

The first thing that jumps out is how many more conversations there were between airlines (blue line) and their customers. That can be attributed to there simply being more passengers, but the two industries operate quite differently. Many train journeys are paid for on the day, and when commuters stopped commuting then they didn’t need to have conversations with the train companies.

For airlines it was a very different situation. Passengers had paid a lot of money for future flights and suddenly were worried about losing the money or wanting to change their journeys for fear of travelling and catching Covid-19.

Regular daily train passengers being asked to work from home could just sit tight and wait until they needed to start train travel again. UK-based train companies, for example, would have been handling queries around season ticket refunds, but it’s a far less complex process than airlines issuing vouchers, credit or refunds.

Revenues for both industries were severely impacted, in the US, eleven of the biggest airlines issued more than $12bn in cash refunds to customers in 2020 and there were similar statistics for operators across the globe. But we’ve written quite extensively about the impact of Covid on airlines, so for this article we wanted to see how consumer habits and attitudes have affected the rail industry and what it means for the future of customer conversations.

How Have Train Operators Been Affected by Covid Lockdowns?

Without wanting to state the obvious – passenger numbers and revenue have been down, by quite a big margin. In the UK 388m journeys were made between April 2020 and March 2021 – which may seem like a decent amount, but it’s 22.3% of the total journeys for the previous year and the lowest since 1872! Europe hasn’t been quite as bad, with passenger numbers down 48% across 24 countries. In big cities like London and New York, the data is telling us the same story.

The MTA saw more than 1bn fewer subway journeys in 2020 compared to 2019 and in London passenger numbers fell off a cliff in March/April last year, from 106m weekly journeys to 5.7m.

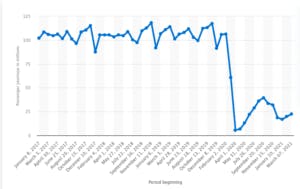

Total weekly journeys on the London Underground

From our own platform, we’ve seen spikes in the volume of customer conversations with rail companies, which have followed a pattern that corresponds with the various states of lockdown over the last 18 months.

Post-lockdown digital customer conversations have remained higher than pre-pandemic levels

There’s the first big spike in March 2020, when everything first locked down, then unlike airlines, where the volume of customer conversations remained higher than pre-covid levels, the number of conversations fell dramatically.

We can also see a spike around July 2020, when the first lockdown ended. People were looking for alternative ways to get away from the same four walls they’d been staring at for the last four months, and with international travel not possible, trains offered that escape. But conversations on messaging channels were at similar levels to pre-lockdown, which dropped off again as soon as lockdowns were enforced at the end of the year.

The most telling part of the graph above is the spike from May 2021 to today. Not only did customer digital customer queries rise to the same volume as March 2020, they have not dropped off since. The number of conversations has remained high.

For one of our partners, there’s been a 120% increase in conversations compared to pre-Covid levels, with the biggest intents around fares and tickets. Obviously the world is beginning to open up, people can and want to travel more but the trend shows something we’ve been seeing across all industries.

Rail passengers don’t exist in a bubble, they’re modern consumers and everything we’ve seen over the past 18 month tells us that they’ve changed their habits to embrace digital solutions.

It’s been a period of low passenger numbers and low revenues for rail operators, which has translated into low digital engagement at times when people simply weren’t travelling. Our data shows that as journeys numbers are starting to grow, so is the level of customer conversations.

Not only that, the growth of engagement via messaging channels like Messenger and WhatsApp is where the spikes are coming. After being forced to stay at home and substitute some face-to-face interactions for digital channels, consumers don’t want to go back.

It’s a development that brands can embrace and use to create more personalized and convenient experiences for their customers. The power of messaging channels allows you to deploy conversational experiences from FAQ bots that address any Covid safety concerns to journey updates and reminders or even ticket purchases or season ticket renewals.

If customers are turning to digital solutions, it’s up to the operators to meet them there and find ways to enhance their CX strategies which meets the expectations of the post-lockdown consumer.